Newspapers miss out on huge growth in digital ad revenue, Pew study finds

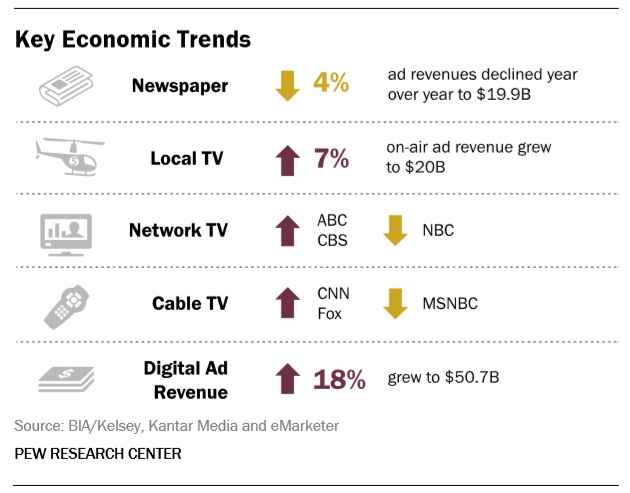

The U.S. newspaper industry continues to suffer revenue declines and is over-reliant on print audience and advertising.

Newspapers continue to be heavily reliant on print advertising and audience as overall revenue declines each year, according to Pew Research Center’s “State of the News Media 2015” report.

They’ve shared in little of the explosive growth in digital advertising revenue, fueled in the past year by mobile and video formats especially.

Newspaper ad revenue from print has dropped from $46.6 billion in 2007 to $16.4 billion in 2014, while newspapers’ digital revenue has increased from only $3.2 billion to $3.5 billion during that time period. To put that in perspective, five companies – Google, Facebook, Microsoft, Yahoo and AOL – generated nearly 10 times that amount of digital revenue – $30.9 billion, on their own in 2014.

Ad revenue at some of the major publicly traded newspaper companies – Gannett, E.W. Scripps, the New York Times, A.H. Belo, Journal Communications, McClatchy and Lee Enterprises – was down 5 percent in retail, 6 percent in national and 5 percent in classified.

Meanwhile, a large percentage of newspapers’ audience still revolve around print – 56 percent actually up from 55 percent in 2013) say they read newspaper content only in print, while only 16 percent in 2014, up from 15 percent the year before, say they read newspaper content only online or via mobile.

Print newspaper circulation, excluding some gimmicks such as “branded editions” that publishers have used to goose their numbers, was down 3.3 percent daily and 3.4 percent Sunday in 2014.

Other highlights of the report:

– Google still leads in overall share of digital revenue – up from $17.1 billion in 2013 to $19.3 billion. But its share of the total dropped at the same time, from 40 to 38 percent. Facebook’s digital revenue was at $5 billion, up from $2.2 billion in 2012.

– Facebook increased its share of digital display ad revenue in 2014 to 24 percent, up from 19, while Google held its share of 14 percent, Yahoo was at 6 percent, AOL at 4 percent and Twitter at 4 percent.

– Facebook also increased its share of mobile display ad revenue in 2014 to 35 percent, up from 29, while Google held its share of 12 percent, Twitter was at 7 percent, Pandora 6 percent and Apple 5 percent.

– Total digital advertising was up 18 percent in 2014, after posting a 17 percent increase the previous year. Digital advertising is now 28 percent of total media advertising across all platforms, up from 25 percent in 2013.

– Digital display ad revenue continues to grow – up 27 percent in 2014, compared with 22 percent growth in 2013. Even much-maligned banner ad revenue is growing, up 12 percent, although its share of the total, while still in the lead, has dropped from 63 percent to 49 percent over the past four years.

– Video ads are growing fastest – up 56 percent in 2014, and has grown from a 14 percent share of the total in 2010 to 27 percent in 2014.

– Mobile advertising totaled $19 billion in 2014, up 78 percent from $10.7 billion in just one year. Its share of total digital ad spending is now at 37 percent, up from 25 percent in 2013.

Sign up for the weekly newsletter

Join the LION mailing list to get our weekly roundup of opportunities and resources for news entrepreneurs. View our most recent issues.

Related Articles

How five LION members are maximizing revenue and community engagement through events

Whether you’re a solopreneur or part of a larger team, there are in-person event opportunities for everyone.

Jess deRivera joins LION Publishers as our Membership Services Manager

She’ll help provide a seamless experience to current and prospective members.

Four big opportunities that local news publishers can pursue right now

Here’s how to capitalize on each one.